what is the total cost of the ending inventory according to fifo?

Inventory

61 Summate the Cost of Goods Sold and Catastrophe Inventory Using the Periodic Method

As you've learned, the periodic inventory system is updated at the end of the flow to suit inventory numbers to match the physical count and provide accurate merchandise inventory values for the balance sheet. The adjustment ensures that merely the inventory costs that remain on paw are recorded, and the residual of the appurtenances available for sale are expensed on the income statement as toll of goods sold. Here we will demonstrate the mechanics used to calculate the ending inventory values using the four price allocation methods and the periodic inventory system.

Information Relating to All Toll Allocation Methods, but Specific to Periodic Inventory Updating

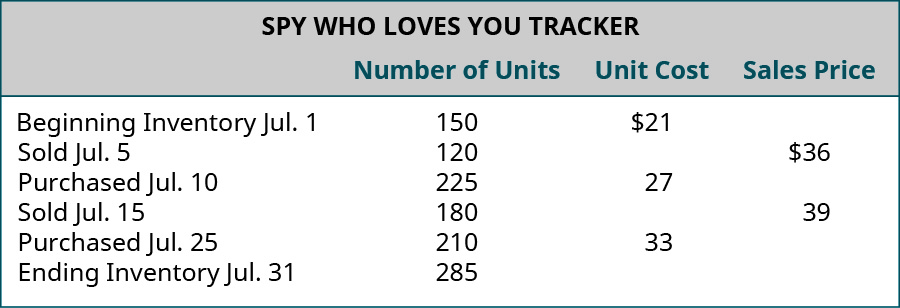

Allow'south render to the instance of The Spy Who Loves You Corporation to demonstrate the four cost resource allotment methods, bold inventory is updated at the end of the period using the periodic organization.

Price Data for Calculations

Company: Spy Who Loves You lot Corporation

Product: Global Positioning Organization (GPS) Tracking Device

Description: This product is an economical real-time GPS tracking device, designed for individuals who wish to monitor others' whereabouts. Information technology is beingness marketed to parents of middle schoolhouse and high school students as a safe measure out. Parents do good by existence apprised of the child'south location, and the student benefits past non having to constantly check in with parents. Demand for the product has spiked during the current fiscal menstruation, while supply is limited, causing the selling price to escalate rapidly. Note: For simplicity of demonstration, showtime inventory cost is assumed to be $21 per unit of measurement for all cost assumption methods.

Specific Identification

The specific units assumed to be sold in this flow are designated every bit follows, with the specific inventory distinction being associated with the lot numbers:

- Sold 120 units, all from Lot 1 (beginning inventory), costing $21 per unit

- Sold 180 units, 20 from Lot one (commencement inventory), costing $21 per unit; 160 from the Lot two (July ten purchase), costing $27 per unit of measurement

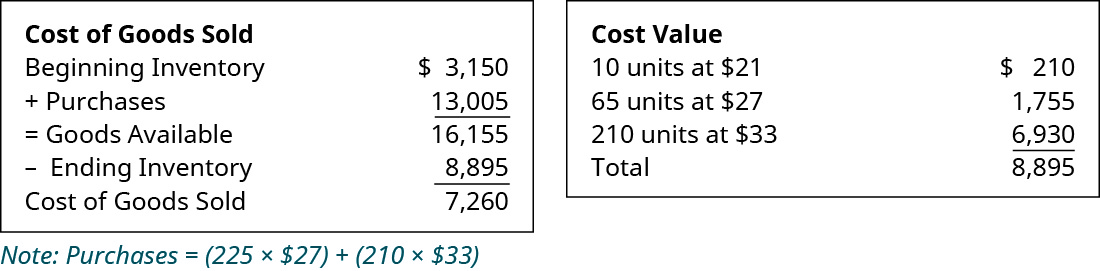

The specific identification method of cost resource allotment directly tracks each of the units purchased and costs them out equally they are actually sold. In this sit-in, assume that some sales were made by specifically tracked goods that are function of a lot, equally previously stated for this method. So for The Spy Who Loves You, because the entire menses together, note that

- 140 of the 150 units that were purchased for $21 were sold, leaving 10 of $21 units remaining

- 160 of the 225 units that were purchased for $27 were sold, leaving 65 of the $27 units remaining

- none of the 210 units that were purchased for $33 were sold, leaving all 210 of the $33 units remaining

Ending inventory was fabricated up of 10 units at $21 each, 65 units at $27 each, and 210 units at $33 each, for a total specific identification ending inventory value of $8,895. Subtracting this ending inventory from the $16,155 total of goods available for sale leaves $7,260 in cost of goods sold this menstruation.

Calculations of Costs of Appurtenances Sold, Ending Inventory, and Gross Margin, Specific Identification

The specific identification costing assumption tracks inventory items individually, so that when they are sold, the exact cost of the item is used to offset the acquirement from the sale. The cost of appurtenances sold, inventory, and gross margin shown in (Figure) were determined from the previously-stated data, particular to specific identification costing.

Specific Identification Costing Supposition Cost of Goods Sold and Cost Value. (attribution: Copyright Rice University, OpenStax, under CC Past-NC-SA four.0 license)

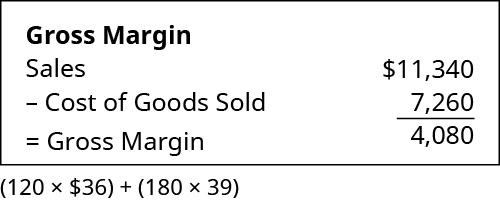

The gross margin, resulting from the specific identification periodic cost allocations of $7,260, is shown in (Figure).

Specific Identification Periodic Cost Allocations Gross Margin. (attribution: Copyright Rice University, OpenStax, nether CC Past-NC-SA 4.0 license)

Calculation for the Ending Inventory Aligning nether Periodic/Specific Identification Methods

Merchandise inventory, earlier adjustment, had a residue of $3,150, which was the beginning inventory. Journal entries are not shown, merely the following calculations provide the data that would be used in recording the necessary journal entries. The inventory at the end of the menstruation should be $8,895, requiring an entry to increase merchandise inventory past $5,745. Cost of goods sold was calculated to be $vii,260, which should be recorded as an expense. The credit entry to balance the aligning is $13,005, which is the total amount that was recorded as purchases for the menstruum. This entry distributes the balance in the purchases account between the inventory that was sold (cost of goods sold) and the corporeality of inventory that remains at catamenia cease (merchandise inventory).

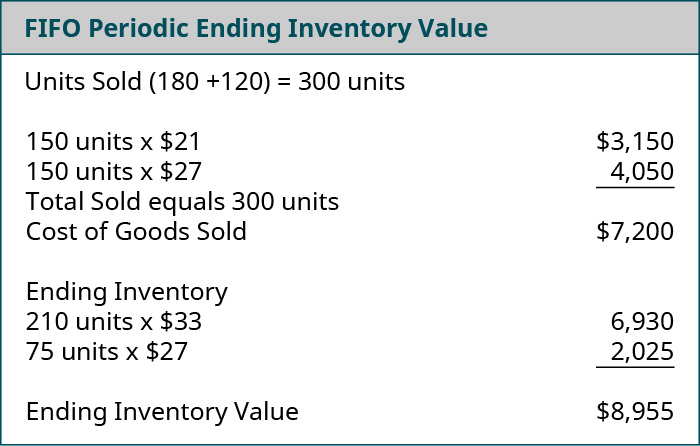

First-in, Get-go-out (FIFO)

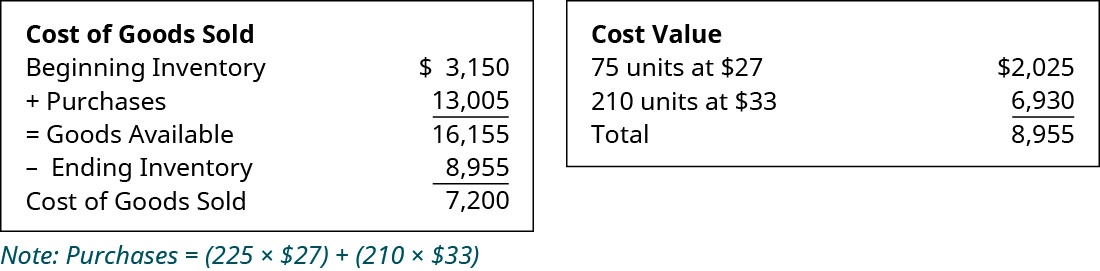

The first-in, first-out method (FIFO) of cost allocation assumes that the primeval units purchased are besides the get-go units sold. For The Spy Who Loves You, because the entire menstruation, 300 of the 585 units bachelor for the menses were sold, and if the earliest acquisitions are considered sold first, so the units that remain under FIFO are those that were purchased last. Following that logic, ending inventory included 210 units purchased at $33 and 75 units purchased at $27 each, for a total FIFO periodic ending inventory value of $8,955. Subtracting this ending inventory from the $16,155 total of goods available for sale leaves $seven,200 in cost of goods sold this menstruum.

Calculations of Costs of Goods Sold, Ending Inventory, and Gross Margin, Offset-in, Starting time-out (FIFO)

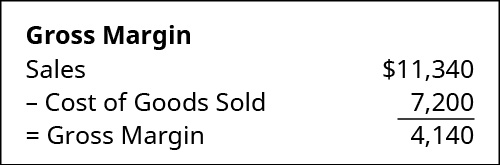

The FIFO costing supposition tracks inventory items based on segments or lots of goods that are tracked, in the order that they were caused, so that when they are sold, the earliest acquired items are used to offset the revenue from the sale. The cost of goods sold, inventory, and gross margin shown in (Figure) were determined from the previously-stated information, particular to FIFO costing.

FIFO Costing Assumption Cost of Goods Sold and Cost Value. (attribution: Copyright Rice University, OpenStax, nether CC BY-NC-SA 4.0 license)

The gross margin, resulting from the FIFO periodic price allocations of $7,200, is shown in (Figure).

FIFO Periodic Toll Allocations Gross Margin. (attribution: Copyright Rice University, OpenStax, under CC Past-NC-SA iv.0 license)

Calculations for Inventory Aligning, Periodic/Beginning-in, Get-go-out (FIFO)

Beginning merchandise inventory had a remainder of $3,150 before adjustment. The inventory at period end should be $8,955, requiring an entry to increase trade inventory past $v,895. Journal entries are non shown, only the following calculations provide the information that would be used in recording the necessary journal entries. Cost of goods sold was calculated to be $7,200, which should exist recorded as an expense. The credit entry to balance the adjustment is for $thirteen,005, which is the full amount that was recorded as purchases for the period. This entry distributes the balance in the purchases account between the inventory that was sold (cost of goods sold) and the amount of inventory that remains at menstruum end (trade inventory).

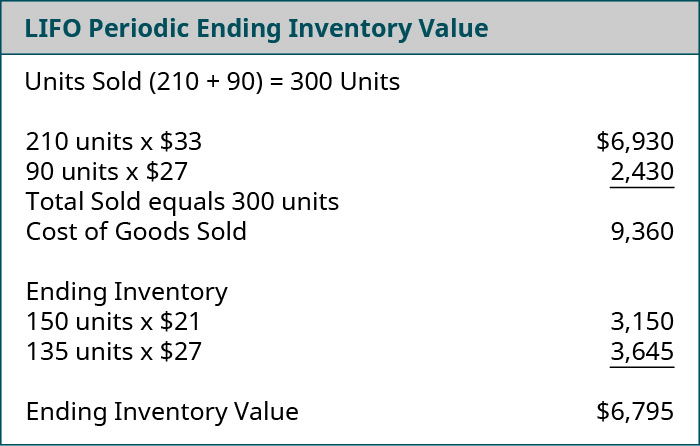

Concluding-in, First-out (LIFO)

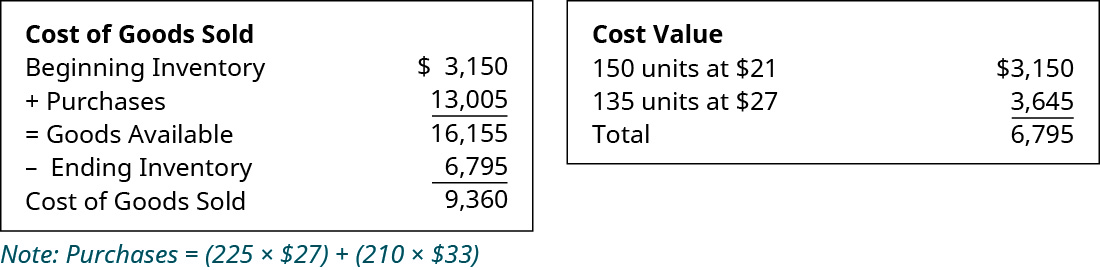

The last-in, showtime-out method (LIFO) of cost allocation assumes that the last units purchased are the first units sold. For The Spy Who Loves You, considering the entire period together, 300 of the 585 units available for the period were sold, and if the latest acquisitions are considered sold first, then the units that remain under LIFO are those that were purchased offset. Following that logic, ending inventory included 150 units purchased at $21 and 135 units purchased at $27 each, for a total LIFO periodic ending inventory value of $6,795. Subtracting this ending inventory from the $16,155 total of goods bachelor for sale leaves $9,360 in cost of goods sold this period.

It is important to note that these answers can differ when calculated using the perpetual method. When perpetual methodology is utilized, the cost of goods sold and ending inventory are calculated at the fourth dimension of each auction rather than at the end of the calendar month. For example, in this case, when the first sale of 150 units is made, inventory will be removed and cost computed every bit of that engagement from the outset inventory. The differences in timing as to when price of goods sold is calculated tin alter the gild that costs are sequenced.

Calculations of Costs of Goods Sold, Ending Inventory, and Gross Margin, Last-in, First-out (LIFO)

The LIFO costing assumption tracks inventory items based on lots of goods that are tracked, in the order that they were acquired, so that when they are sold, the latest acquired items are used to first the revenue from the auction. The following cost of goods sold, inventory, and gross margin were determined from the previously-stated information, particular to LIFO costing.

LIFO Costing Supposition Cost of Appurtenances Sold and Price Value. (attribution: Copyright Rice University, OpenStax, under CC Past-NC-SA iv.0 license)

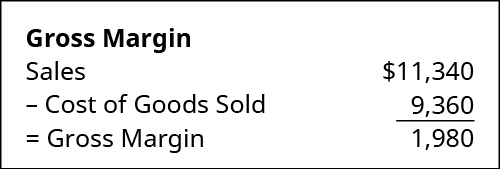

The gross margin, resulting from the LIFO periodic cost allocations of $nine,360, is shown in (Figure).

LIFO Periodic Cost Allocations Gross Margin. (attribution: Copyright Rice University, OpenStax, nether CC Past-NC-SA 4.0 license)

Calculations for Inventory Adjustment, Periodic/Last-in, First-out (LIFO)

Beginning merchandise inventory had a balance before adjustment of $3,150. The inventory at menstruum finish should be $6,795, requiring an entry to increase merchandise inventory by $three,645. Journal entries are not shown, but the following calculations provide the information that would be used in recording the necessary journal entries. Cost of goods sold was calculated to be $9,360, which should exist recorded as an expense. The credit entry to balance the adjustment is for $13,005, which is the total amount that was recorded as purchases for the period. This entry distributes the balance in the purchases account between the inventory that was sold (price of goods sold) and the amount of inventory that remains at period end (merchandise inventory).

Weighted-Average Toll (AVG)

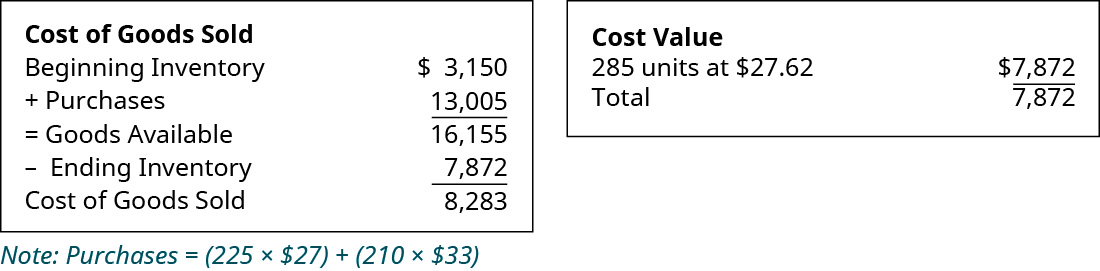

Weighted-boilerplate toll allocation requires computation of the boilerplate cost of all units in goods bachelor for sale at the time the auction is fabricated. For The Spy Who Loves Yous, because the entire period, the weighted-boilerplate price is computed by dividing total cost of goods available for auction ($16,155) by the full number of available units (585) to get the boilerplate cost of $27.62. Annotation that 285 of the 585 units available for auction during the menstruum remained in inventory at period finish. Following that logic, ending inventory included 285 units at an average cost of $27.62 for a total AVG periodic ending inventory value of $7,872. Subtracting this ending inventory from the $xvi,155 total of goods available for sale leaves $8,283 in cost of goods sold this catamenia. It is important to notation that final numbers tin can often differ by one or two cents due to rounding of the calculations. In this case, the price comes to $27.6154 simply rounds upwardly to the stated cost of $27.62.

Calculations of Costs of Goods Sold, Catastrophe Inventory, and Gross Margin, Weighted Average (AVG)

The AVG costing assumption tracks inventory items based on lots of goods that are tracked but averages the cost of all units on hand every time an add-on is made to inventory and so that, when they are sold, the near recently averaged cost items are used to commencement the acquirement from the sale. The cost of goods sold, inventory, and gross margin shown in (Figure) were determined from the previously-stated information, particular to AVG costing.

AVG Costing Supposition Cost of Goods Sold and Cost Value. (attribution: Copyright Rice University, OpenStax, under CC By-NC-SA iv.0 license)

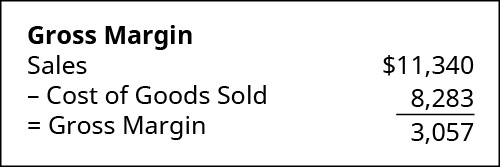

(Effigy) shows the gross margin resulting from the weighted-average periodic cost allocations of $8283.

Weighted AVG Periodic Cost Allocations Gross Margin. (attribution: Copyright Rice University, OpenStax, under CC BY-NC-SA 4.0 license)

Periodical Entries for Inventory Adjustment, Periodic/Weighted Boilerplate

Beginning trade inventory had a remainder before adjustment of $iii,150. The inventory at catamenia finish should be $7,872, requiring an entry to increase merchandise inventory by $4,722. Journal entries are non shown, but the following calculations provide the data that would be used in recording the necessary journal entries. Price of goods sold was calculated to be $8,283, which should exist recorded as an expense. The credit entry to residual the adjustment is for $13,005, which is the total corporeality that was recorded every bit purchases for the menstruation. This entry distributes the residual in the purchases account between the inventory that was sold (toll of appurtenances sold) and the amount of inventory that remains at period cease (merchandise inventory).

Central Concepts and Summary

- The periodic inventory arrangement updates inventory at the stop of a fixed accounting period. During the accounting flow, inventory records are not changed, and at the end of the period, inventory records are adapted for what was sold and added during the period.

- Companies using the periodic and perpetual method for inventory updating cull betwixt the bones four cost period supposition methods, which are first-in, first-out (FIFO); last-in, outset-out (LIFO); specific identification (SI); and weighted average (AVG).

- Periodic inventory systems are nevertheless used in practice, but the prevalence of their apply has greatly macerated, with advances in technology and as prices for inventory management software have significantly decreased.

(Figure)Which of these statements is faux?

- If price of goods sold is incorrect, ending inventory is unremarkably incorrect too.

- beginning inventory + purchases = cost of goods sold

- ending inventory + toll of goods sold = goods available for auction

- appurtenances available for sale – beginning inventory = purchases

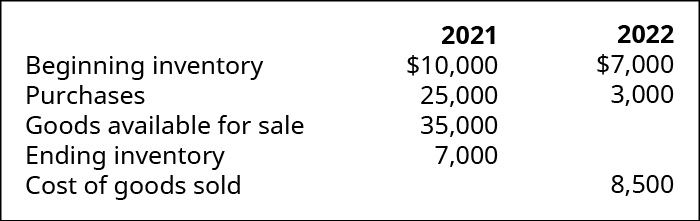

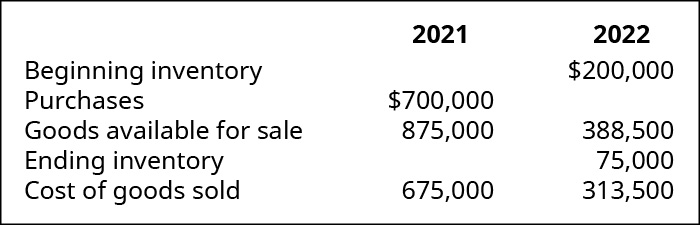

(Figure)Complete the missing piece of data involving the changes in inventory, and their relationship to goods available for auction, for the two years shown:

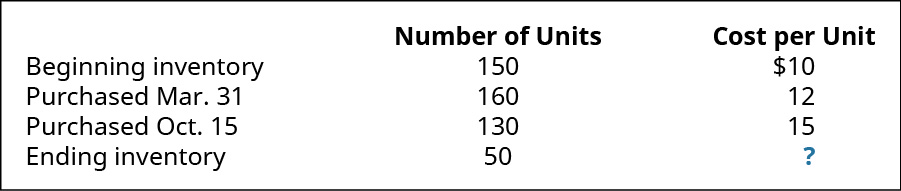

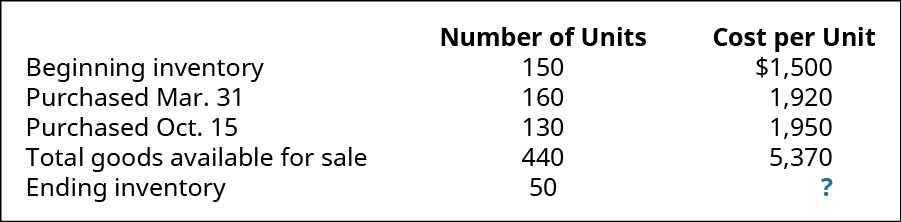

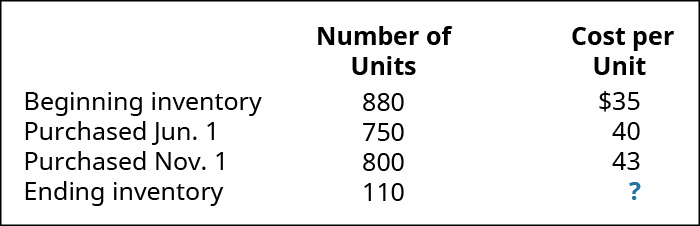

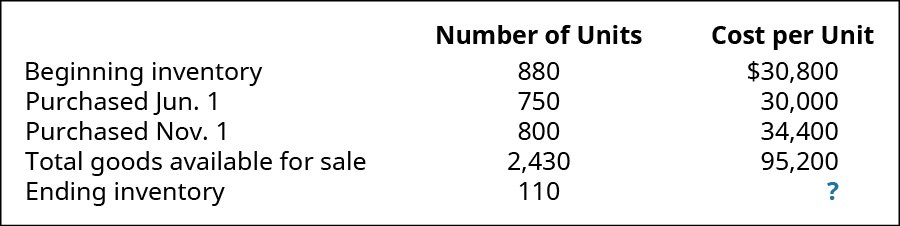

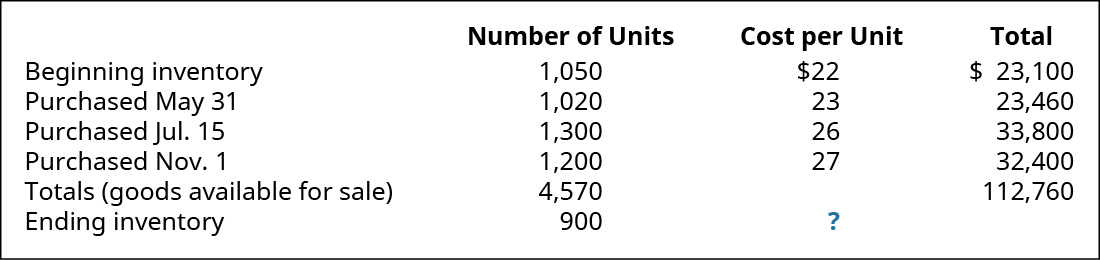

(Figure)Akira Company had the following transactions for the month.

Calculate the catastrophe inventory dollar value for the period for each of the following toll allocation methods, using periodic inventory updating. Provide your calculations.

- offset-in, first-out (FIFO)

- last-in, first-out (LIFO)

- weighted average (AVG)

(Figure)Akira Company had the following transactions for the month.

Calculate the gross margin for the period for each of the following price resource allotment methods, using periodic inventory updating. Assume that all units were sold for $25 each. Provide your calculations.

- first-in, first-out (FIFO)

- last-in, first-out (LIFO)

- weighted average (AVG)

(Effigy)Prepare periodical entries to tape the following transactions, assuming periodic inventory updating and start-in, first-out (FIFO) cost allocation.

(Figure)Consummate the missing piece of information involving the changes in inventory, and their relationship to goods bachelor for sale, for the two years shown.

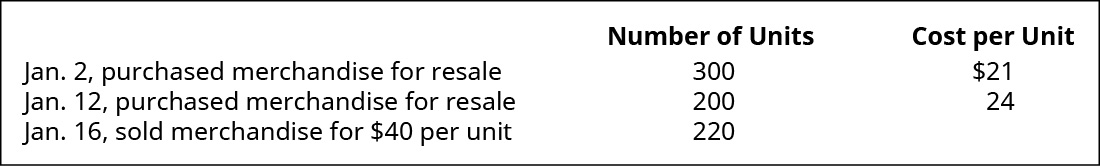

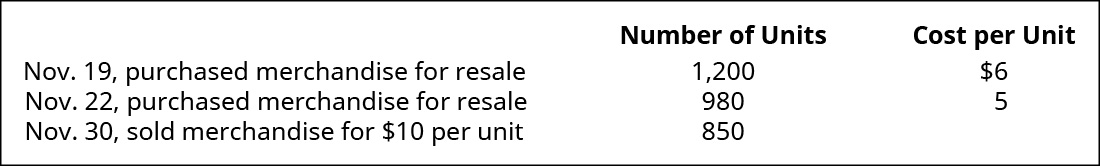

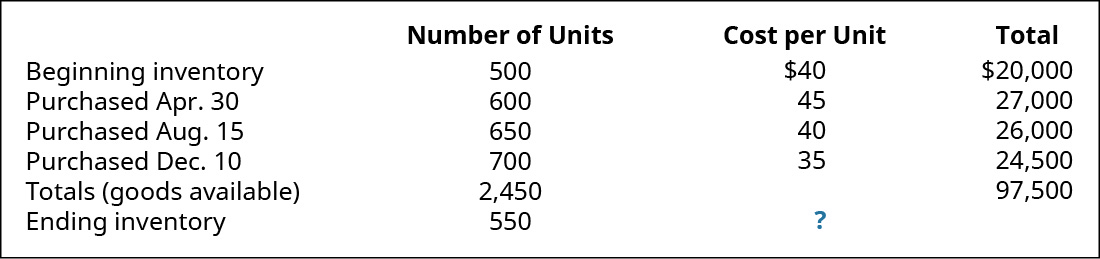

(Figure)Bleistine Company had the post-obit transactions for the calendar month.

Calculate the ending inventory dollar value for each of the post-obit price allocation methods, using periodic inventory updating. Provide your calculations.

- first-in, first-out (FIFO)

- terminal-in, kickoff-out (LIFO)

- weighted average (AVG)

(Figure)Bleistine Company had the following transactions for the month.

Calculate the gross margin for the period for each of the following cost allocation methods, using periodic inventory updating. Assume that all units were sold for $fifty each. Provide your calculations.

- first-in, get-go-out (FIFO)

- last-in, showtime-out (LIFO)

- weighted average (AVG)

(Effigy)Prepare journal entries to record the post-obit transactions, assuming periodic inventory updating and first-in, offset-out (FIFO) cost allocation.

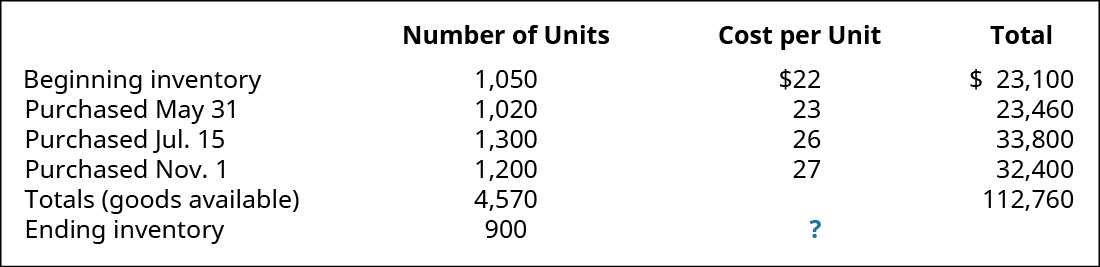

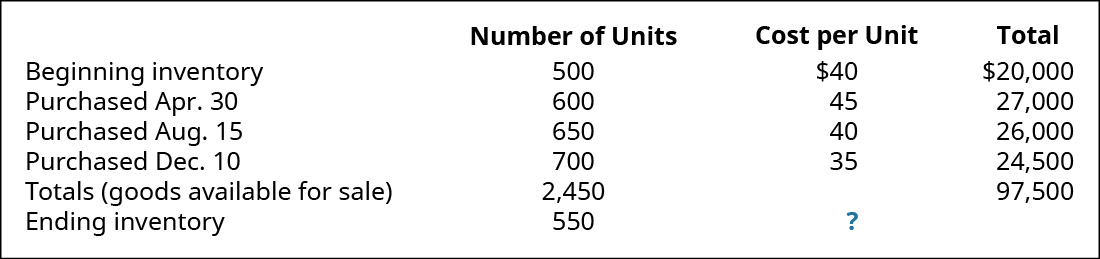

(Figure)Trini Company had the following transactions for the month.

Calculate the ending inventory dollar value for each of the following price allotment methods, using periodic inventory updating. Provide your calculations.

- beginning-in, first-out (FIFO)

- final-in, first-out (LIFO)

- weighted average (AVG)

(Figure)Trini Company had the following transactions for the month.

Calculate the cost of goods sold dollar value for the catamenia for each of the following cost allocation methods, using periodic inventory updating. Provide your calculations.

- first-in, beginning-out (FIFO)

- last-in, first-out (LIFO)

- weighted boilerplate (AVG)

(Effigy)DeForest Company had the following transactions for the month.

Calculate the ending inventory dollar value for the menses for each of the following price allocation methods, using periodic inventory updating. Provide your calculations.

- outset-in, first-out (FIFO)

- terminal-in, first-out (LIFO)

- weighted average (AVG)

(Effigy)DeForest Company had the following transactions for the month.

Calculate the ending inventory dollar value for the period for each of the following cost allocation methods, using periodic inventory updating. Provide your calculations.

- outset-in, first-out (FIFO)

- terminal-in, first-out (LIFO)

- weighted boilerplate (AVG)

(Figure)Assume your company uses the periodic inventory costing method, and the inventory count left out an entire warehouse of goods that were in stock at the finish of the year, with a toll value of $222,000. How will this bear on your net income in the electric current year? How will information technology affect next yr's internet income?

Source: https://opentextbc.ca/principlesofaccountingv1openstax/chapter/calculate-the-cost-of-goods-sold-and-ending-inventory-using-the-periodic-method/

0 Response to "what is the total cost of the ending inventory according to fifo?"

ارسال یک نظر